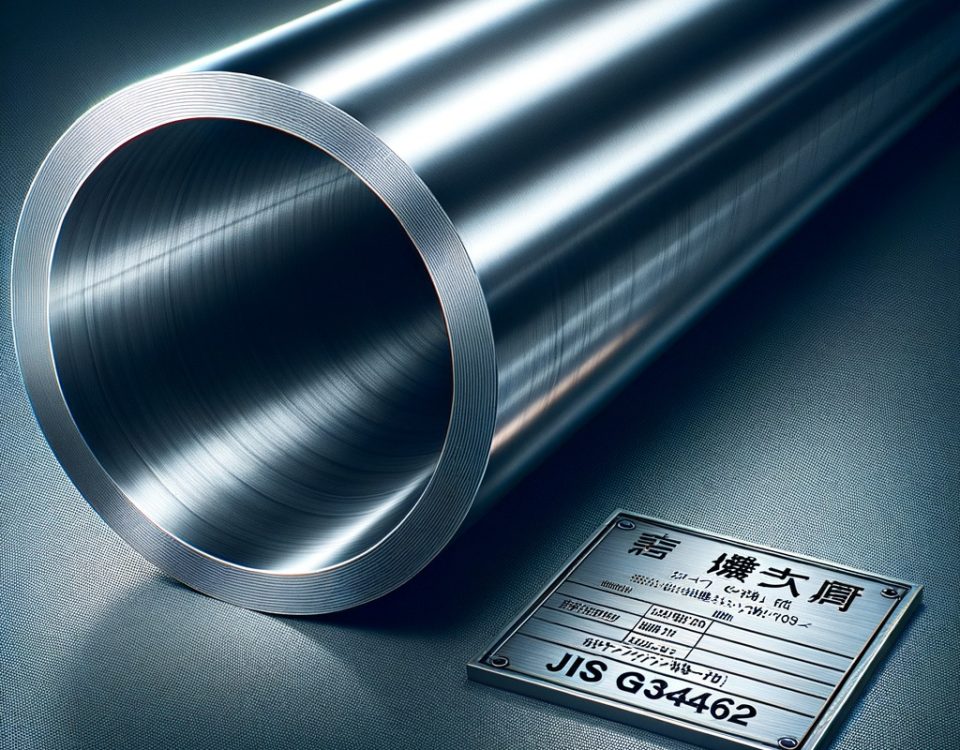

Definition, purpose and characteristics of ERW

May 11, 2021Material classification of oil transmission pipeline

May 18, 2021It is expected that the relatively large adjustment of import and export tariffs of Chinese steel products will have two impacts on the international steel market situation in this year:

One is to reduce the supply of resources.Since the fourth quarter of last year, the world economy has recovered significantly, the global manufacturing index continues to be above the 50-point line between expansion and contraction, and the massive infrastructure plan promoted by the new U.S. President Joe Biden has pushed up the demand for steel in Europe and the United States, and pushed up the demand for steel in the international market.On the other hand, because of the serious epidemic, in addition to China’s steel production in many countries blocked;And before that, the United States and other Western countries raised trade protectionism and imposed tariffs on steel products, “moving stone” and impeding resource imports.Under this background, China, which accounts for half of the world’s steel production, will restrain steel exports, and the steel resources in the international market will be bound to reduce, expanding the gap between supply and demand in the future.

Second, it will help steel prices rise in the international market.For some time, the international market, especially European and American steel prices so up, the primary factor is the overall tight supply and demand relationship.There is also a view in the US that scarcity and tension are driving up US steel prices.China has substantially adjusted import and export tariffs on steel and steel products, giving priority to steel production to meet domestic demand, which of course has created a new driving force for rising steel prices in the international market.

According to this, we can draw a preliminary judgment: the overall trend of the international steel market within the year is tight prices, steel prices will further rise.